PCCS Group Bhd Malaysia has long been known as a garment manufacturer and a label maker, but as the second generation of the family-run business takes over, the focus of the group is beginning to change.

With nearly five decades of experience in making apparels, PCCS Malaysia has been a supplier to many brands including Puma, Adidas, Li-Ning, H&M and Decathlon. Apart from Malaysia, the group’s garment business is also present in China and Cambodia.

PCCS Malaysia is also one of the largest label and packaging makers in Malaysia, via its subsidiary Mega Label (M) Sdn Bhd Malaysia, which was established in 1987.

Supported by these two businesses, the group has been making over RM400mil-RM500mil in annual sales, but the turnover has been declining in recent years.

The group was not spared from the impact of the Covid-19 pandemic and has recorded losses in the past two quarters.

For the first nine months ended Dec 31,2020, PCCS Malaysia reported a net loss of RM2.81mil as compared to a net profit of almost RM6mil a year earlier.

The main issue with PCCS Malaysia is that its biggest revenue contributor – garment manufacturing – only delivers low single-digit net profit margins.

The label and packaging business, on the other hand, has been loss-making.

Group managing director David Chan Wee Kiang, who was promoted to the position in November 2020, acknowledges that PCCS’ low-margin conditions have affected the group’s earnings trajectory.

Wee Kiang is the eldest son of PCCS founder and single largest shareholder Chan Choo Sing.

Choo Sing is also currently the executive chairman of PCCS. The Chan family controls over 40% of PCCS.

Looking ahead, Wee Kiang believes that the group needs a new growth strategy.

“Diversification is the only answer, especially into high-margin businesses that deliver stable earnings, ” he tells StarBizWeek.

Hence, it is no surprise that PCCS Malaysia has announced the venture into new business segments since last year, namely, medical device distribution and hire purchase financing.“Both businesses would be able to give the group commendable net profit margins of 20% to 30%, as compared to the group’s current margin of below 5%.

“They will also be the main revenue contributors to PCCS Malaysia in the future. Within the next couple of years, the medical device segment is expected to deliver over 30% to the bottom line, while the hire purchase business could contribute about 20%.

“Nevertheless, I remain committed to the group’s existing businesses, ” he says.

In April this year, PCCS said it will be investing RM4mil to enter into the used vehicle financing and insurance business, focusing on the Johor and Melaka markets.

This business will be undertaken via Southern Auto Capital Sdn Bhd, a joint venture company in which PCCS Malaysia holds 80% interest.The balance 20% stake is owned by Justin See Kok Wah, who is an adviser to 365 Capital Sdn Bhd, a company principally engaged in the business of used cars financing.

Wee Kiang says the group wants to capitalise on See’s long-built experience in the second-hand vehicle financing and auto insurance business.

“We believe that the used car financing segment is under-tapped in Malaysia, hence we want to capitalise on the available market opportunities. The hire purchase business is expected to deliver its first profit in the first quarter of 2022, ” he adds.

As for the medical device distribution business, which was first announced in December 2020, Wee Kiang says it will take about two years to generate revenue and deliver its first profit.“For us to distribute medical devices, we need to first obtain approvals from respective medical device regulators in the markets we intend to penetrate.

“The approval process will typically take one to two years, depending on the jurisdictions, ” he says.

Last week, PCCS, via its subsidiary La Prima Medicare Pte Ltd Malaysia, entered into an exclusive agreement with Shanghai Shenqi Medical Technology Co Ltd to distribute the latter’s medical devices within Asia-Pacific, excluding China and Japan.

The agreement will be in effect until May 21,2023, and La Prima has the right to extend the agreement for a further two years.

The agreement allows PCCS Malaysia to distribute Shenqi’s medical devices related to cardiology or heart-related diseases.

These include medical diagnosis and treatment of congenital heart defects, coronary artery disease, heart failure, valvular heart disease and electrophysiology.

Founded in 2014, China-based Shenqi is primarily engaged in the development of minimally invasive surgery products and devices, enabling safer and more reliable cardiovascular surgeries. Its products are primarily designed for cardiovascular interventional and peripheral vascular interventional procedures.

“We are already in the process of getting Shenqi’s products registered in some of the Asean countries. We will make the relevant announcements when necessary, ” he says.

Given the rising cardiovascular diseases across the world, including among the younger population, Wee Kiang says this has created a huge market for innovative and niche medical devices.

“PCCS hopes to ride on this demand, in partnership with Shenqi.

“We aren’t just another company jumping into the medical bandwagon. We are serious about growing the medical business for PCCS, ” says Wee Kiang.

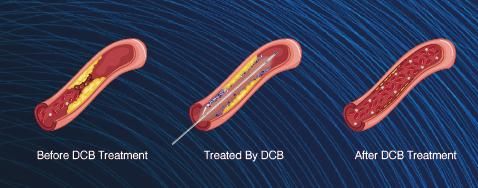

He also points out that among the initial products that would be distributed by PCCS is Shenqi’s self-developed drug-coated balloon (DCB) catheter.

The DCB catheter is an alternative to drug-eluting stents that are used to treat coronary artery disease. The product was registered with China’s National Medical Products Administration in December 2019.

Wee Kiang describes the DCB catheter as a “star product” of Shenqi in China, given the huge demand. He expects to replicate the success by introducing the DCB catheter to the Asia-Pacific markets.

In addition to the medical device distribution business, Wee Kiang says PCCS is working on developing its own medical devices.

“The research and development works are still ongoing, hence I could not provide more details. But once everything is finalised, this will be another good revenue stream for the group with higher margins as the products are developed in-house, ” he adds.

Wee Kiang’s ambition to turn PCCS into a diversified group is supported by its balance sheet. As of end-December 2020, the group sits on a net cash position, with almost RM60mil in cash and cash equivalents against RM53.1mil in total borrowings.

Its gearing ratio of 29%, which Wee Kiang describes as optimal, would also allow PCCS to seek bank financing when necessary.

This provides the group ample room to expand organically and inorganically over the longer term.

If you would like to have more information, you can contact [email protected].