450 days from February 2021 to April 2022

2,270 patients enrolled at 43 clinical centers across China

1,132 patients with swide® Drug Coated Coronary Balloon

1,138 patients with the 2nd generation Sirolimus Eluting

All Estimated Patients Have Been Successfully Enrolled

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat.

On April 30, 2022, the enrollment was successfully completed for Paclitaxel-coated Balloon for Treatment of De Novo Non – complex Coronary Artery Lesions: an Open-label, Multicentre, Randomised, Non-inferiority Trial ( CAGE-FREE I, a randomized controlled trial ) . This randomized controlled trial (RCT) was initiated by Ling Tao M.D ( Professor in Cardiology, Director of the Department of Cardiology from Xijing Hospital of Air Force Medical University) , and sponsored by Shanghai Shenqi Medical Technology Co., Ltd. (hereinafter referred to as “Shenqi Medical”).

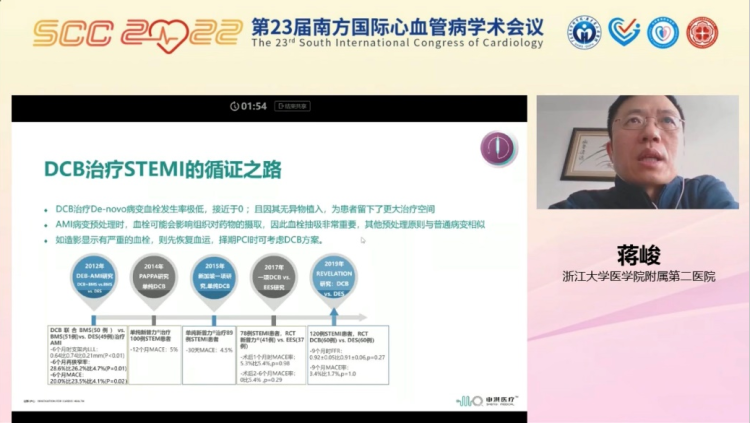

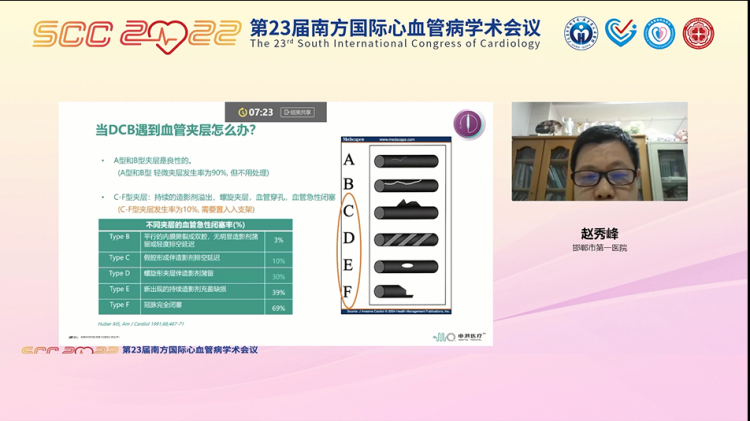

In recent years, the concept of “leave nothing behind,” represented by Drug-coated Balloon (DCB) in the treatment of coronary artery lesions, has been increasingly recognized by interventional cardiologists. DCB is a novel treatment strategy for coronary artery lesions based on The fast and homogeneous transfer of antiproliferative drugs into the vessel wall during single balloon inflation by means of a lipophilic matrix without the use of permanent implants. Compared with DES, DCB allows better restoration of the vessel’s physiological function and precludes permanent implants, thus diminishing the likelihood of foreign body reaction.

In light of the EBM, the efficacy of DCB treatment strategy has been increasingly recognized. As recommended by the European Society of Cardiology guidelines, the level of evidence of DCB treating ISR is IA. However, DCB’s efficacy in treating de novo coronary artery lesions remains Controversial. Although the safety and effectiveness of DCB in the treatment of de novo small-vessel diseases has been substantiated by the BASKET-SMALL 2 Trial published in The Lancet in 2018, there is no large-scale RCT comparing the clinical outcomes of DCB versus DCB DES in large vessels with de novo lesions. Therefore, the effectiveness of DCB-only strategy in the treatment of large vessels with de novo lesions has become a clinical issue in needs of interventional cardiologists’ exploration.

The Results of the RCT May Fill in the Gaps in Including De Novo Lesions To DCB’s Indications

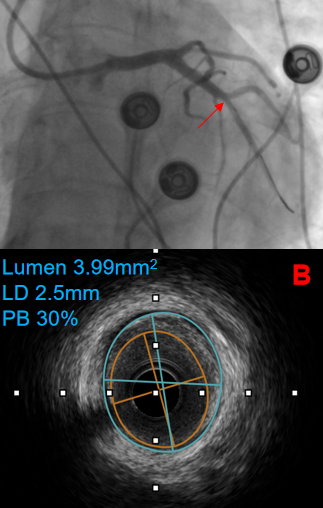

The enrollment for CAGE-FREE I was initiated in February 2021. The RCT is intended to evaluate whether the efficacy of Paclitaxel-coated balloon is non-inferior to that of Sirolimus-eluting stent for the treatment of de novo non-complex coronary artery lesions . The primary endpoint is a 24-month Device-oriented Composite Endpoint (DoCE), which is a composite clinical endpoint of cardiac death, target vessel myocardial infarction (TV-MI), and clinically indicated target lesion revascularization (CI-TLR). All patients will be followed up continuously for 24 months after the enrollment.

At present, a total of 2,270 patients have been successfully enrolled at 43 clinical centers across China. The enrolled patients are those with indications for PCI due to acute or chronic coronary syndrome, with de novo non-complex lesions, and have undergone successful pre- dilation. All patients were randomized by the clinical centers in a parallel assignment when the RCT entered clinical study phase. 1,132 patients were implanted with Shenqi Medical’s DCB, swide®, whereas the other 1,138 patients were implanted with the 2nd generation Sirolimus-eluting stents. The patients have an average age of 61, 69% male, 26% with diabetes mellitus, and 60% with hypertension. During the PCI, 35%, 35% and 42% of the patients were pre-dilated with scoring balloons, cutting balloons and non-compliant balloons respectively.The mean diameter of the implanted DCBs is 3.13 mm.

As the first large scale RCT with a clinical “hard endpoint” in the treatment of de novo large-vessel lesions, the results of Cage-Free I are expected to provide EBM for the efficacy of DCB-only treatment in de novo non-complex lesions, demonstrating and popularizing the latest concept of “leave nothing behind.”

Shanghai Shenqi Medical Technology Co., Ltd. (Shenqi Medical) is a high-tech enterprise founded in 2014 and headquartered in Shanghai Zhangjiang Hi-Tech Park. Shenqi Medical is dedicated to R&D, manufacturing, and sales of innovative medical devices, offering a comprehensive product portfolio providing solutions for cardiovascular, structural heart disease, peripheral, and neurovascular medical devices in China. Shenqi Medical has also invested in Beijing HeartCare Medical Technology Co., Ltd. (Beijing HeartCare), the first Chinese company to develop heart failure ultrafiltration equipment.

Deeply rooted in China, Shenqi Medical has long been committed to “innovation for cardio health.” With the mission of “satisfying the rapidly-growing needs arising from China market,” Shenqi Medical will continue to strengthen research and development capabilities and expand the product portfolio, providing comprehensive and high-quality solutions for Chinese patients.

All Estimated Patients Have Been Successfully Enrolled in

CAGE-FREE I at 43 Clinical Centers in 27 Cities Across China

This article is only for reference by healthcare professionals and does not constitute any medical advice;

Any information of this article can only be reprinted upon authorization and with the source indicated.

Read more here: https://www.sqmedical.com/#/product/listDetail?code=NSE20220608hDXO